Since economists and business heads have made several predictions about recession and economic stagnation for 2023, the current business landscape is staring at an unpredictable horizon. However, we decided to unravel what CFOs have on their minds and, most importantly, which areas they are planning to invest in this year.

What CFOs are thinking

Just because an economic slump is expected, not all budget items are subject to financial restrictions. While some CFOs are too cautious about every step they keep, on the side of the spectrum, many CFOs say they is no reason to balk, and this could be the right time to seize the opportunity and invest.

According to Deloitte’s fourth-quarter 2022 North American CFO Signals survey, about 57% of CFOs said their companies plan to seek mergers and acquisitions and joint ventures. When asked about their plans for 2023, nearly 2/3rd of surveyed CFOs said they are willing to allocate or reallocate capital to new business investments, and about 49% say they intend to increase investments in ESG.

PwC Pulse Survey (Nov – 22) found that nearly 68% of CFOs are confident that they can achieve near-term growth goals in the coming year.

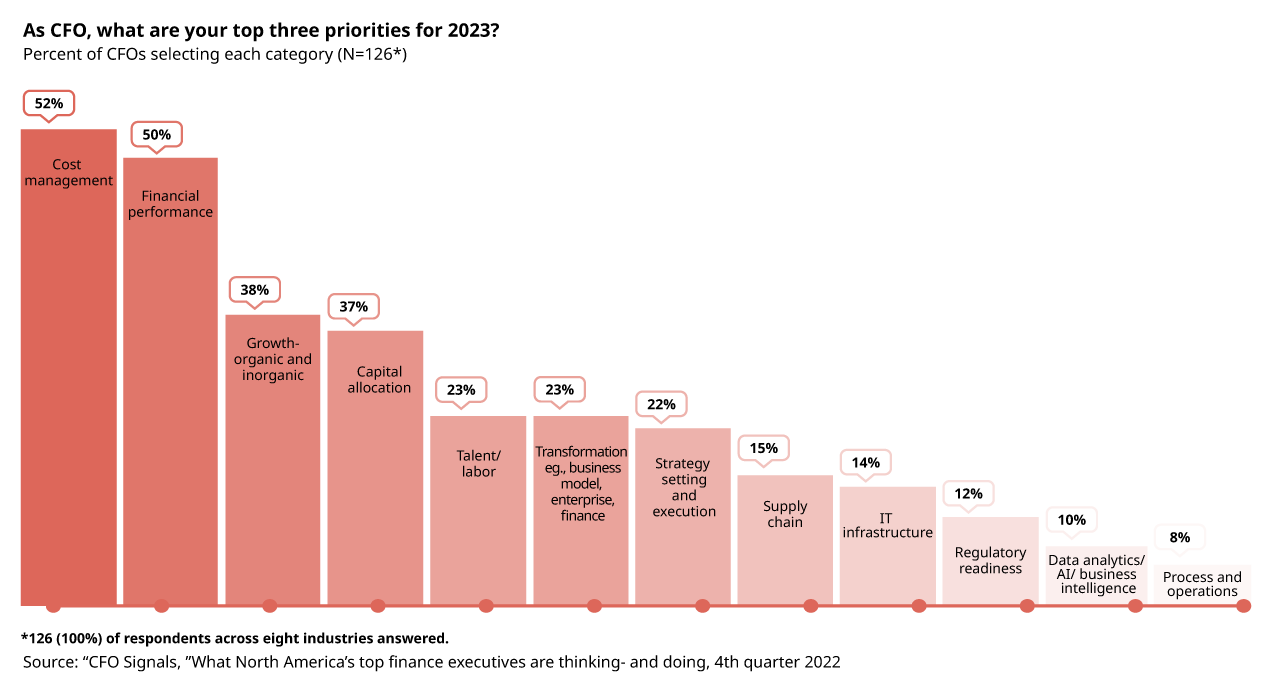

Top priorities of CFOs for 2023

Areas CFOs prefer to invest

Smart Technology

According to the CFO State of the Market 2023 report, CFOs are becoming wiser about how

much money they spend when the economy is down. Investing in technology is at the top of the investment list for many CFOs. By investing in technology and providing their employees with competitive compensation packages, they believe they can guarantee their companies’ success regardless of economic uncertainty.

Hiring talents

CFOs are still positive about recruiting in 2023. Only 21% believe it will be more challenging than it is now. With 61% of them looking at these tactics, they also consider offering top talent big wages and fantastic benefits. The top hiring priorities for the upcoming year are for FP&A, AP/AR, and controllership posts.

Digital Transformation

Digital transformation is not a task that can be set and forgotten. It requires continuous learning, testing, iteration, and execution. Thus, it continues to be a strategic priority for businesses this year.

According to a recent Bank of America report, the emerging technologies that are most likely to be significant to small businesses over the next ten years include cybersecurity (57%), 5G (50%), automation (39%), artificial intelligence (34%), cryptocurrency (26%), virtual/augmented reality (25%), the metaverse (20%), and non-fungible tokens (NFTs) (16%).

Health Care

As remote treatment became necessary due to the pandemic, many hospitals and health systems were forced to engage in digital transformation. However, the last year’s financial difficulties have forced many CFOs to change their investment strategies for 2023.

The 2023 BDO Healthcare CFO Outlook Survey found that this year, significantly more CFOs are spending on primary care (55% more than in 2022), elder care (27% more than in 2022), and home care (24% more than in 2022).

Wrapping it up

Despite their concerns about a recession, CEOs and CFOs seem optimistic they can survive the economic downturn. Preparation, optimism, and adaptability are essential. Having a high degree of agility and a desire to explore new models will be crucial in the year ahead.

We at Blue Hellion offer expert financial advice, help identify opportunities even during downturns, and enable you to invest strategically in the right areas. We also lend execution support, backed with the right tools and knowledge, to help you stay afloat in the market during uncertain times.

Get a free, no-obligation 20-minute consultation with our experts