The weather of mergers and acquisitions in the tech industry has been dicey in the recent past. After doing exceptionally well the year before, 2022 saw a sudden plunge, and gloom closed in. The stock plunged, and growth was hindered, throwing investors off-track.

But toward the end of 2022, the forecast changed.

As of 2023, it appears that the dealmakers and investors are rolling up their sleeves and are eager to resume their activities in a market that has recently been chugging along at a rate of almost half-trillion dollars in spending each year. This represents a fantastic opportunity for acquirers as lower valuations exist as does the desire to exit certain markets

Let us look at the standing position for M&A in the tech industry, the key trends shaping it up, the challenges in M&A, and, of course, the future of M&A in the technology sector.

Tech Industry Merger & Acquisitions in 2023

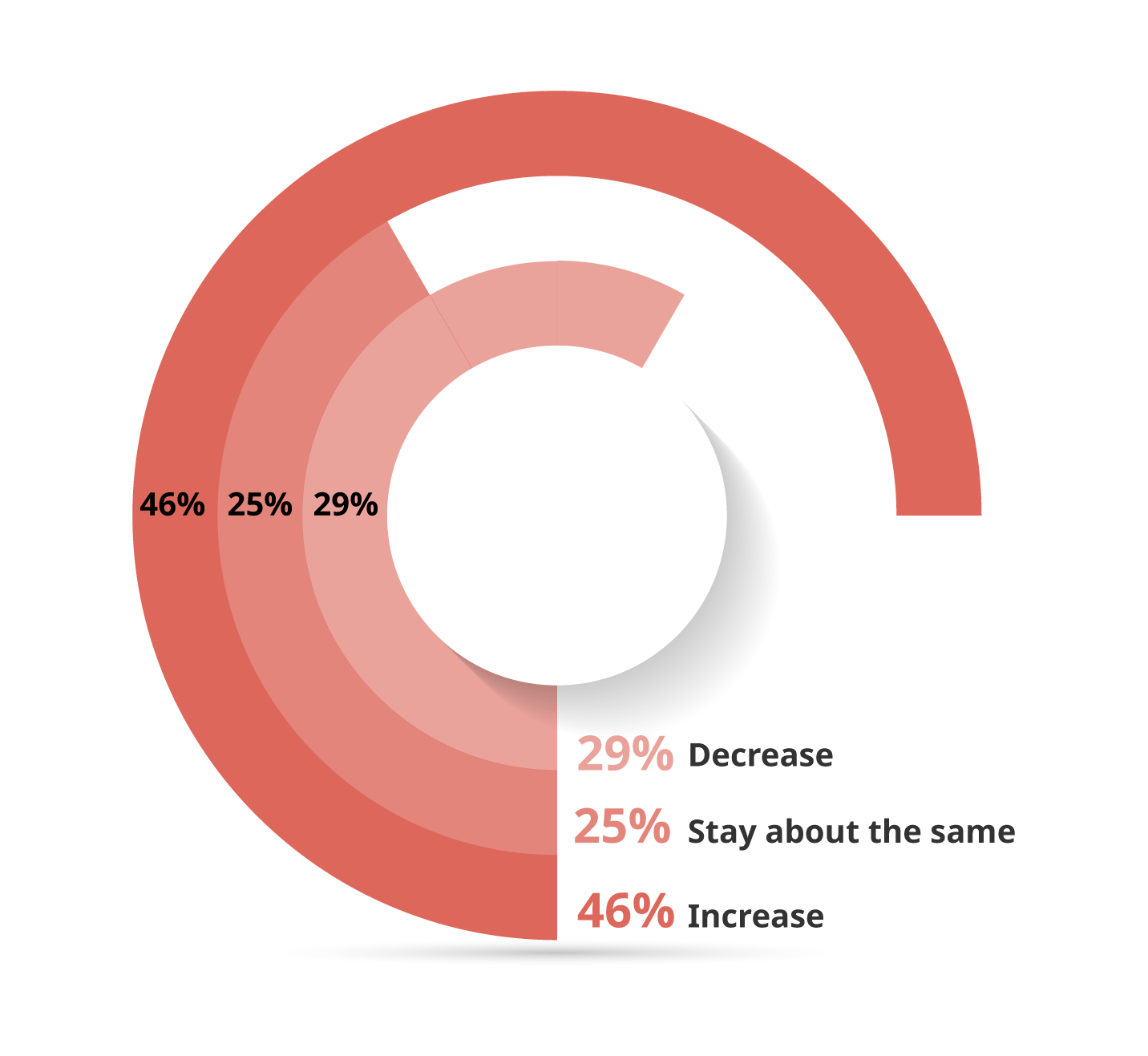

According to 451 Research’s annual Tech M&A Outlook survey, slightly fewer respondents expected a downturn (29% versus 31%), while about 46% expected an increase compared to 28% in the previous year. However, a lot relies on where you are when it comes to what you see.

Having said that, the tech industry will need to start booming again to get transactions moving again. Companies have been compelled to reevaluate the business they already have rather than necessarily looking to add to it due to the slowdown the industry faced last year. This includes segments that were previously regarded to be “recession-proof.

Challenges in M&A

Pricing and valuation in the technology sector

Accurately evaluating and pricing the targets of a technology M&A deal is one of the biggest hurdles. Given the speed at which technology is developing, it can be challenging to accurately predict future cash flows and profitability, which might cause possible acquisition targets to be overvalued or undervalued.

Furthermore, the great demand for cutting-edge technologies and creative businesses increases the risk of overpaying for acquisitions, which occasionally leads to inflated valuations.

Managing integration of advanced technologies

It can be time-consuming and expensive to combine different systems, platforms, and applications, which could interrupt corporate operations and delay the realisation of synergies.

For the management of the integration process and to guarantee a seamless transition, careful planning, and efficient communication are essential.

Meeting regulations and compliance

As technology mergers and acquisitions continue to increase, regulatory bodies and antitrust authorities are paying closer attention. They are particularly worried about the negative impact these deals could have on competition, especially when big tech companies are involved.

Companies must navigate this complex regulatory environment carefully, ensuring they comply with antitrust laws and other regulations while pursuing their strategic M&A transactions.

The future of Merger and Acquisition in the technology industry

The future of M&A in the technology industry may be influenced by a number of developing trends and possible disruptors as the technology landscape continues to change. Here are some of the more significant ones:

The Metaverse impact

To give you a quick overview of the metaverse, it is an immersive digital online environment that connects social and commercial activities using technologies like virtual reality and augmented reality to produce 3D virtual worlds that look and feel like the real world.

Metaverse mergers and acquisitions have touched a $77 billion mark during the last 15 months. That is the impact it is creating in recent times. This increase in metaverse M&A indicates the rising confidence in virtual environments and digital assets like NFTs; people are making significant amounts of real money worldwide. It looks like this one is going to be a future-defining trend.

Larger deals will be on the rise

As businesses merge to boost scale and efficiency, the average size of M&A agreements is expected to rise. The most important agreements from the current consolidation in these areas will likely be made in the healthcare and technology sectors.

Growth of not just tech but non-tech companies as well

Technology continues to converge across industries, opening up M&A prospects for both tech and non-tech organisations. For instance, non-tech businesses might benefit from technological mergers and acquisitions to digitise operations, enhance customer experiences, and maintain competitiveness in a changing market.

Tech businesses can take advantage of cross-industry M&A opportunities simultaneously to broaden their reach and develop new revenue sources.

Wrapping it up

The landscape is constantly evolving, driven by rapid technological advancements, shifting market dynamics, and the pursuit of innovation. As tech companies seek to stay competitive and expand their capabilities, strategic mergers and acquisitions have become crucial tools for growth.

We at Blue Helion deliver unparalleled expertise, offering transformative guidance and unwavering support throughout the acquisition and merger journey. Our commitment lies in empowering businesses engaged in these crucial endeavors, ensuring a seamless and hassle-free experience.

Get a 20-minute, no-obligation consultation with one of our M&A experts