FinTech companies are adopting a 24/7 operations model to provide competent, dependable, and high-quality services, which has increased the need for outsourcing partners. Today, an increasing number of FinTech companies have turned to third-party specialists to help them overcome challenges and expand operations.

If you are a CEO, CFO, CTO of a FinTech company mulling over outsourcing some of the business services, this blog will be of great help to you. You will learn the types of services that you can outsource, the benefits, and the key factors to consider before outsourcing.

Let’s get started.

Key Findings in FinTech Outsourcing

Outsourcing is becoming a critical component of any growth plan for FinTech companies aiming to scale quickly with agility. Collaborations are replacing rivalry, as seen by market trends like Open Banking, BaaS (Banking as a Service), and embedded finance. A growing number of FinTech businesses are using outsourcing to swiftly and effectively develop and expand their capabilities and enter new industry verticals.

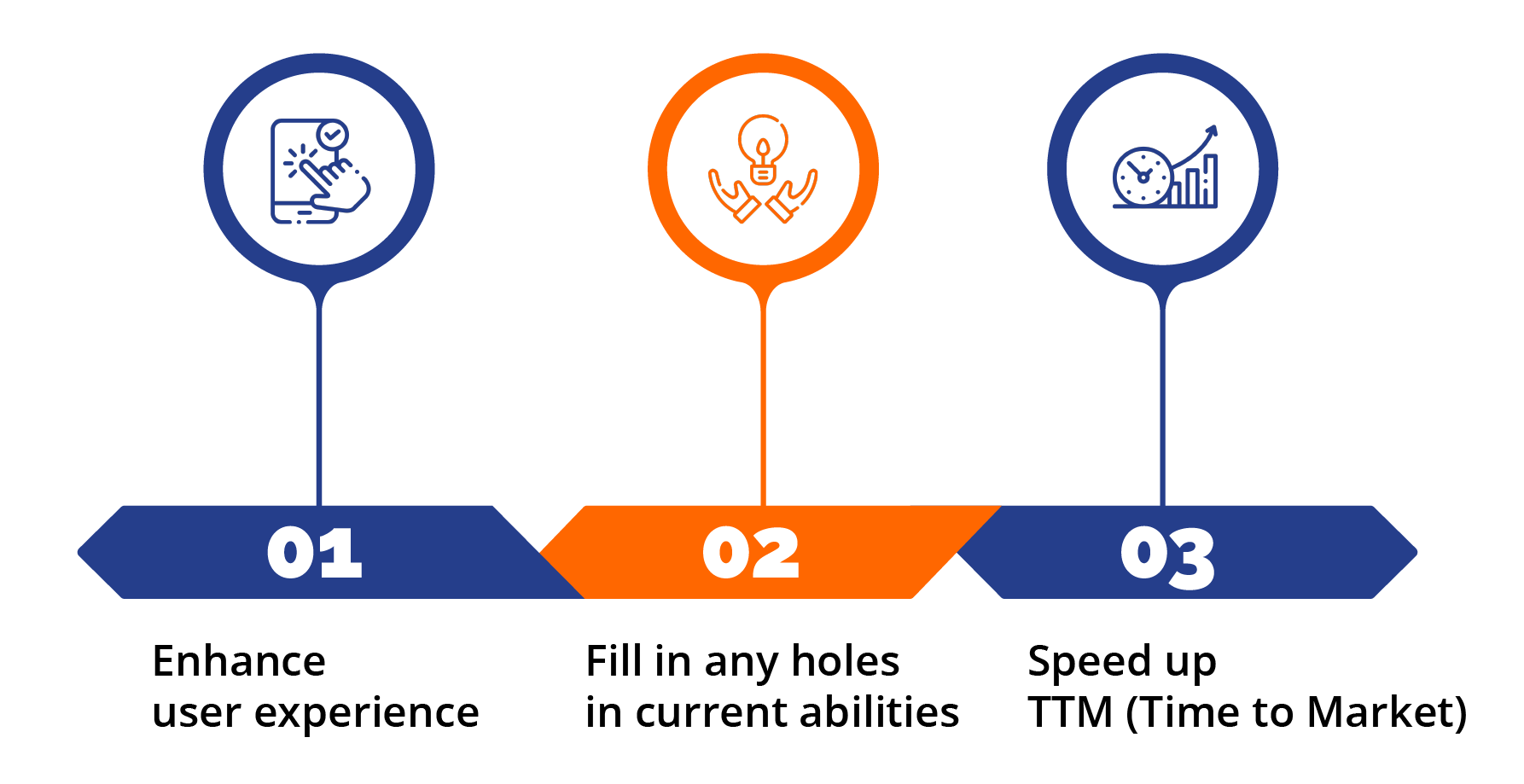

Here are the top three factors motivating FinTech companies to outsource:

2022 UK IT Sourcing report findings

“2/3 of organisations in the UK plan to outsource at the same rate or more in the next two years, with 32% confirming they will outsource more.”

“62% of survey respondents say that in-house capability is the principal challenge to deliver complex transitions.”

“Apart from cost, outsourcing is done to focus on core business (57%) and gain access to resources/talent (56%).”

Services that FinTech Companies Can Outsource

As the outsourcing trend is gaining traction, FinTech companies have begun to outsource a wide range of services to outsourcing firms, such as customer service, IT services, and product development, among others. Below are some of the areas that are widely outsourced.

Data analytics

A growing number of FinTech businesses are choosing to outsource data analytics since it allows them to enter a new area with little to no experience. Today’s outsourcing firms use cutting-edge tools like the Internet of Things (IoT), AI, and ML to glean valuable information from data analytics, helping FinTech companies make significant business decisions and gain competitive advantage.

Back office tasks

Back-office outsourcing frees FinTech organisations from unnecessary chores so they can focus on other critical tasks. The following back-office functions can be outsourced:

- Digital Marketing (e.g., SEO, social media management, PPC, content moderation, etc.)

- Sales/Recruitment/Accounting

- Legal assistance

- Remote/Virtual Assistance

IT outsourcing

Among the most frequently outsourced services for FinTech initiatives are IT services. Here are some of the standard IT services outsourced are:

- FinTech software maintenance

- IT product development

- App development

- FinTech tech support

It eliminates the need to spend money on purchasing hardware, software licensing or setting up and maintaining an internal infrastructure.

How FinTech Companies Can Benefit Through Outsourcing

Indeed, outsourcing has a lot of advantages that can be tapped into. Here, we’ve listed some of the most significant benefits that outsourcing can provide for FinTech businesses.

Speedier project delivery

FinTech companies outsource their services to guarantee quick and efficient project delivery. Projects can be started immediately and completed quickly because there is no need to find and train new staff.

Access to the right experts/technology

Outsourcing firms can equip FinTech companies with the right talents and technologies based on specific requirements. This becomes especially instrumental, considering the global scarcity of technology and development specialists.

Cost-efficiency

Outsourcing is more affordable than setting up a fully-staffed internal department. As outsourcing firms often manage these, you won’t have to worry about things like establishing an in-house team, management charges, payroll costs, or infrastructure expenditures.

Improved data management

Being in the financial services industry necessitates routine data collection and analysis. Nowadays, most companies strengthen this service by combining their internal staff with an external FinTech outsourcing partner. Outsourcing partners may aid in integrating tried-and-tested analytics technologies, creating insightful dashboards, and providing cybersecurity expertise to safeguard critical data within the organisation.

Things You Need to Consider While Choosing Outsourcing Partner

There are numerous service providers from which to pick. However, not all of them can be an ideal fit for you. Here are some things to take into account when choosing an outsourcing partner.

Safety and regulation

Pick a service provider with robust data security protocols in place. An efficient technique to make sure that a service provider is protecting your information is to look for an ISO certification.

Staff competency

The main goal of outsourcing is to expand the company’s workforce and enhance the work output. Therefore, you require a service provider that thoroughly trains employees and continually monitors, evaluates, and improves their output.

Value for money

Opt for an outsourcing firm that offers an affordable price structure. Additionally, your service provider should be able to produce top-notch outcomes in any price range. Pick an outsourced firm that offers flexible pricing and high-quality services.

Wrapping Up

When deciding between hiring an outsourced partner and creating an internal team of engineers, you should base your selection on your budget, language and geographical preferences, and the tech stack you require.

Are you a FinTech company looking to lead your FinTech operations by optimising cost and leveraging the best of talents and modern technology? We at Blue Helion can help you develop an integrated outsourcing strategy to increase the value of your FinTech operations while eliminating tedious and frequently repetitive tasks. This will free you to focus on other critical factors of your business.